September 4th, 2020

posted

by Andrew Blomme on 9/3/2020

in

Weekly Newsletter

Week of September 4th, 2020

Another month is behind us for 2020 and I don’t think we are too sad to see it go. This week’s newsletter will include an update on fertilizer pricing and outlook from Lou, Andrew’s observations from the fields, and a look at Herbers Seed’s financing option for our 2021 seed customers.

Lou Herbers

Harvest season is upon us once again. We have been busy planning and preparing for our typically busy fall fertilizer application season. To assist in that process, the following is an update of current fertilizer pricing and an outlook as best as I know it.

Phosphates (P)

Of all the fertilizers, this nutrient has been the most volatile lately. Earlier in 2020 we hit 15-year lows. We bounced off of those lows and then threw gas on the fire when Mosaic filed a countervailing duty lawsuit against phosphate importers, primarily directed at Russia and Morocco. The wholesale market has rallied more than $100/ton off of those lows and product is actually quite snug for fall due to reduced imports. Fortunately, Herbers Seed bought product early and is well positioned for fall in terms of product availability and price. I expect the wholesale market to remain firm through fall/winter and start to decline again by mid next year. The final outcome of the lawsuit will likely determine future price movement.

Potassium (K)

This market could put you to sleep. Much of the product used in the US now originates from Canada which as a country has ample reserves that will last for several hundred years. In the recent past there has been more competition from product that originates in Russia and Belarus making its way to the US. The potash market reset lower with summer fill and has been flat since then. There is an attempt to raise the price with the recent turmoil in Belarus but I’m not sure it will be sustainable. Longer term there may be some price increases but there is a lot of production waiting on the sidelines if this market were to move substantially higher, so I think we are “capped” at moderate levels. I see no reason for any big price moves in the next 6 months and expect wholesale pricing to be steady to firm.

Sulfur (S)

Sulfur has become an essential nutrient that needs to be added to our cropping systems. Gone are the days of enough free product falling from the sky in rainfall. Sulfur, like nitrogen, is a mobile nutrient; it needs to be applied ahead of corn each year. With above average rainfall last summer, sulfur shortages became apparent very quickly this spring. Alfalfa shows very good response to S; soybeans as well although it appears to a lesser degree. Sulfur pricing has been steady to lower and I expect that trend to continue. We get our CalSul (21% Ca, 17% S) (pelletized ground gypsum) from Calcium Products in Ft Dodge. That product is mined and the price has been mostly steady. Ammonium sulfate (AMS 21-0-0-24) is a dry product that comes from a number of sources and has declined in price from last year. Ammonium Thiosulfate (12-0-0-26) is a liquid product that has seen price declines because of additional capacity that has been added. One example is a new plant built by Flint Hills (Koch) at Rosemont, Minnesota. This plant was built adjacent to the Flint Hills refinery there that removes the sulfur from crude oil that originates in the Bakken oil fields in North Dakota and Canada and then uses it to make ATS.

Nitrogen – 32%

As usual we bought 32% in July for summer fill and are hauling in product daily. Pricing was comparable to the level of three years ago and at some of the lowest levels in the past 10 years. The wholesale price has moved up slightly and I expect that trend to continue. Producers (and maybe retailers alike) would like the price to continue to appreciate as we head into winter. If prices move too much higher foreign suppliers will export product to the US and force the price lower again. It is a balancing act by the domestic producers to get as high of price as possible without attracting a lot of imports. Any combination of weather events that would curtail the fall and spring ammonia seasons would certainly put upward pressure on the liquid market.

Ammonia

I think all retailers have summer filled at good values and were able to contract a portion of their unknown fall tons. Wholesale values are $60-$70/ton lower than last fall. Going forward it is all about the weather and how much ammonia we are able to apply this fall. If conditions are suitable and we have a long fall application season, I think ammonia prices will appreciate this fall. If it is a short fall or too dry to apply, prices will remain flat and we will be paying some storage. I do not foresee lower prices for spring regardless of the fall season.

The economics of grain farming are less than favorable and we are looking at a drought-induced short crop. Budgets will be tight. In spite of that I would encourage you to stay with your regular fertility program for several reasons:

1.) As mentioned previously, fertilizer prices are at recent historical lows. Everything cycles including commodities like corn, soybeans, and fertilizer. It is less expensive to maintain soil test levels with today's fertilizer prices.

2.) Although this year's crop removal for P & K will be lower, we are often fertilizing for multiple years with one application. The last several crops have had very large removal rates and we haven't always kept up with that removal.

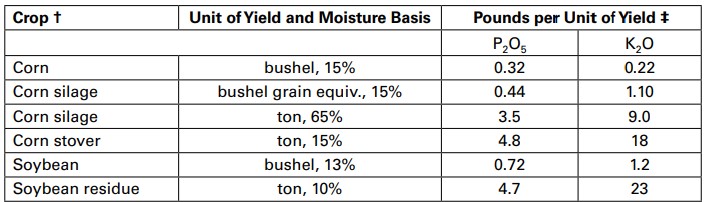

Please find below a chart from ISU PM1688 that shows nutrient removal by crop. Farmers are often surprised to learn that what they thought was an aggressive fertilizer program is actually not keeping up with crop removal.

Michael has been updating soil fertility plans and soil testing schedules; please schedule a time with him to review if you haven’t already done so. Collin and Trevor have been working on equipment and are nearly ready for the season to begin. This spring Herbers Seed built a new hoop structure to increase our dry fertilizer storage capacity to over 25,000 tons. During the summer we made numerous repairs and replacements in the existing fertilizer shed to reduce or eliminate any down time during the busy season. Dry fertilizer continues to arrive daily and we will be full of product by mid-September. We traded our JD4045 dry spreader for a new machine which will be here any day. We are adding twelve more sets of ammonia tanks on Dalton running gear to bring our total fleet to 78 sets of doubles. We continue to invest in equipment and facilities that are safe, modern, clean and efficient.

Andrew Blomme

As every week passes we get closer and closer to harvest. This week, I mostly noted crop progression towards maturity and observed different hybrids reactions to drought stress.

Last week we experienced extreme heat and very arid conditions. This week was much more mild which is to the benefit of the crop. That being said, there are multiple fields out in the countryside that had milk lines with about 1/4 of the kernel left to go. It won't be uncommon to find black layered corn in about 7 days especially in the earlier planted and shorter season hybrids.

With the drought, we have been able to see differences in hybrids that we normally wouldn't.. The picture below shows how different hybrids and different genetic families have reacted to this drought. In general, Family G hybrids have held on better in drought conditions this year.

2021 Seed Financing

We are offering a seed financing option for 2021 through John Deere Finance. This program is unique to Herbers Seed. All of the seed brands that we sell can be combined for volume discounts and changes can be made after the initial purchase without penalty. Andrew and Lou will be able to answer any questions you may have about this program.